This is a free, trial version of Abacus Accounts that is limited to entering 50 transactions, after which you can transfer your entered data to the full, paid version, if you wish. That way you can try the app., to see if it meets your requirements, before purchasing.

Abacus Accounts is a double-entry bookkeeping application, suitable for keeping the accounts of any business or other organisation (or even your personal accounts). It supports accounts for up to 10 separate entities.

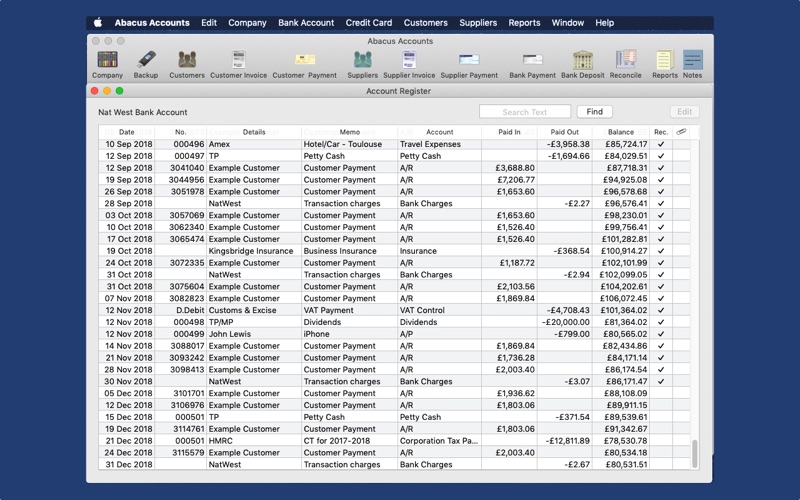

Various types of accounts can be set up, to suit your business. Selections are made using buttons or menu options, whilst transaction entries are made through popup panels. The program is flexible, with VAT/Tax rates being customisable. However, it has been designed to be quick and easy to use.

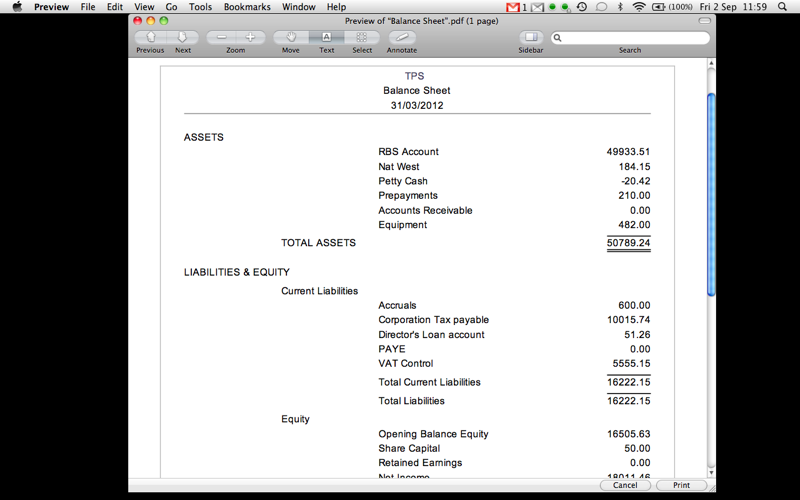

The essential bookkeeping requirements are covered, such as VAT/Tax (optional), tracking of customer/supplier balances and all the normal end of year reports. You are also able to create and print (or email) customised customer invoices. Please note that the app does not connect to UK HMRC directly, but will export the MTD VAT data which can be transmitted electronically using a bridging application. More information is available on the website.

A detailed description of how to use the package is included in the help pages.

Technical support is available by email, free of charge.

Please visit the website (www.abacusaccounts.net) for more information.

Some of the features:

* Easy to use double-entry accounting package.

* Supports Multiple Companies or other organisations (up to 10).

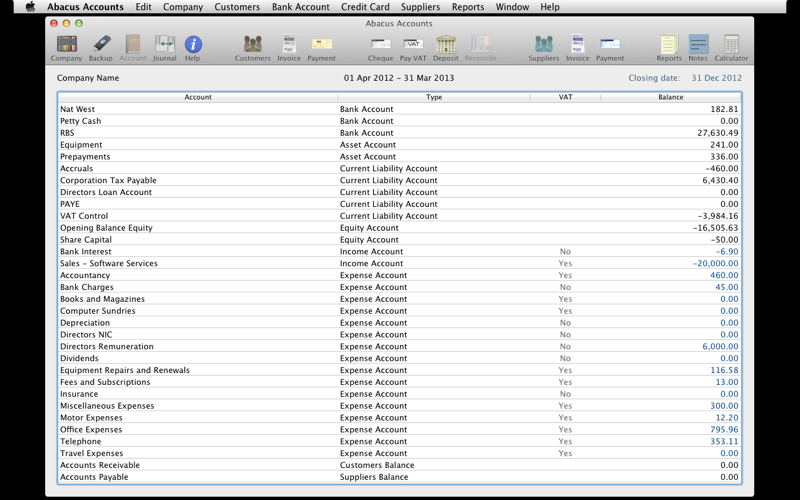

* Chart of accounts defined by the user (including bank accounts, credit card accounts, asset, liability, equity, income and expense accounts).

* Track bank accounts, credit cards, income, expense, assets, depreciation, liabilities etc..

* Ability to delete (void) or edit transactions.

* Enter customer and supplier invoices/credit notes.

* Print Customer Pro Forma Invoices.

* Track customer and supplier payments/balances.

* Protect entries using a Closing date.

* Reconcile bank accounts & credit card accounts.

* Recurring Bank Account/Credit Card payments & Bank deposits.

* Repeat (memorised) transactions.

* Journal entries.

* Attach an image or pdf file to a transaction.

* VAT/GST/Tax calculated automatically, based on rate defined.

* Supports VAT Flat Rate scheme.

* Comprehensive Reports (see below).

* Exporting of reports to CSV files.

* Print (or email) customer invoices/credit notes (using your own logo or headed paper).

* Backup and Restore function.

* Detailed Help pages (including video screencasts).

* Fast email support.

Reports:

* Balance Sheet (3 alternative formats)

* Profit & Loss (alternative formats)

* Trial Balance

* All/Selected Accounts

* Debtors/Creditors

* Customer/Supplier Reports

* Customer Sales Summary Report

* VAT Report/VAT Detailed Report (Accrual or Cash basis)

* Journals Report

* Cash Flow Report